Cryptocurrency & Web3

Here’s what happened in crypto today

Today in crypto, Pakistan's Crypto Council proposes mining BTC with excess, runoff energy, crypto analysts anticipate continued pressure owing to trading wars until April, and Tether is in discussions with a Big Four accounting firm to conduct a full financial audit. Newly commissioned Pakistan Crypto Council proposes mining Bitcoin with excess energy The newly commissioned Crypto Council of Pakistan proposed mining Bitcoin with runoff energy at the group's inaugural meeting on March 21 amid other policy proposals to establish a clear framework for digital assets in the country. According to The Nation , the Bank of Pakistan's governor, the chairman of Pakistan's Securities and Exchange Commission (SECP), the federal information technology secretary, and lawmakers were present at the meeting. Bitcoin mining helps to stabilize electrical loads and balance demand in an energy grid. Source: Science Direct Before the inaugural meeting of the group, Bilal bin Saqib, the CEO of Pakistan's Crypto Council, wrote in a March 20 X post : "Pakistan is done sitting on the sidelines! We want Pakistan as the leader in blockchain-powered finance. Pakistan is a low-cost high-growth market with 60% of the population under 30. We have a web3 native workforce ready to build. " This initiative represents a massive departure from the government of Pakistan's previous stance on cryptocurrencies, which sought bans on digital assets and crypto trading activities in the country. Crypto markets will be pressured by trade wars until April: analyst Despite a multitude of positive crypto-specific developments, global tariff fears will continue pressuring the markets until at least April 2, according to Nicolai Sondergaard, research analyst at Nansen.

Gold-backed stablecoins will outcompete USD stablecoins — Max Keiser

Gold-backed stablecoins will outcompete US dollar-pegged alternatives worldwide due to gold's inflation-hedging properties and minimum volatility, according to Bitcoin ( BTC ) maximalist Max Keiser. Keiser argued that gold is more trusted than the US dollar globally, and said governments of foreign nations with an adversarial relationship to the United States would not accept dollar-pegged stablecoins. The BTC maximalist added: "Russia, China, and Iran are not going to accept a US dollar stablecoin. I predict they will counter the USD stablecoin with a Gold one. China and Russia have a combined 50,000 tonnes of Gold — more than what is reported. " The potential for gold-backed stablecoins to outcompete dollar-pegged tokens in international markets would upend plans to extend US dollar dominance through stablecoins proposed by US lawmakers. Source: Max Keiser Related: Gov't can realize gains on gold certificates to buy Bitcoin: Bo Hines Gold-backed stablecoins fulfill the original promise of USD? Stablecoin issuer Tether launched a gold-backed stablecoin called Alloy (aUSD₮), backed by Tether's XAU₮ — a token that provides a paper claim to physical gold — in June 2024. According to PointsVille founder and former VanEck executive Gabor Gurbacs, "Tether Gold is what the dollar used to be before 1971. " "XAU₮ is up 15.

The current BTC 'bear market' will only last 90 days — Analyst

The current Bitcoin ( BTC ) bear market, defined as a 20% or more drop from the all-time high, is relatively weak in terms of magnitude and should only last for 90 days, according to market analyst and the author of Metcalfe's Law as a Model for Bitcoin's Value , Timothy Peterson. Peterson compared the current downturn to the 10 previous bear markets, which occur roughly once per year, and said that only four bear markets have been worse than the price decline in terms of duration, including 2018, 2021, 2022, and 2024. The analyst predicted that BTC will not sink deeply below the $50,000 price level due to the underlying adoption trends. However, Peterson also argued that based on momentum, it is unlikely that BTC will break below $80,000. The analyst added: "There may be a slide in the next 30 days followed by a 20-40% rally sometime after April 15. You can see that in the charts around day 120. This would probably be enough of a headline to bring weak hands back into the market and propel Bitcoin even higher. " Crypto markets experienced a sharp downturn following United States President Trump's tariffs on several US trading partners, which sparked counter-tariffs on US exports, leading to fears of a prolonged trade war. Comparison of every bear market since 2025. Source: Timothy Peterson Related: Is Bitcoin going to $65K?

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Bitcoin had a relatively calm week following so much recent chaos, with ETF flows in the green and the SEC delivering good news on mining....

The SEC Resets Its Crypto Relationship

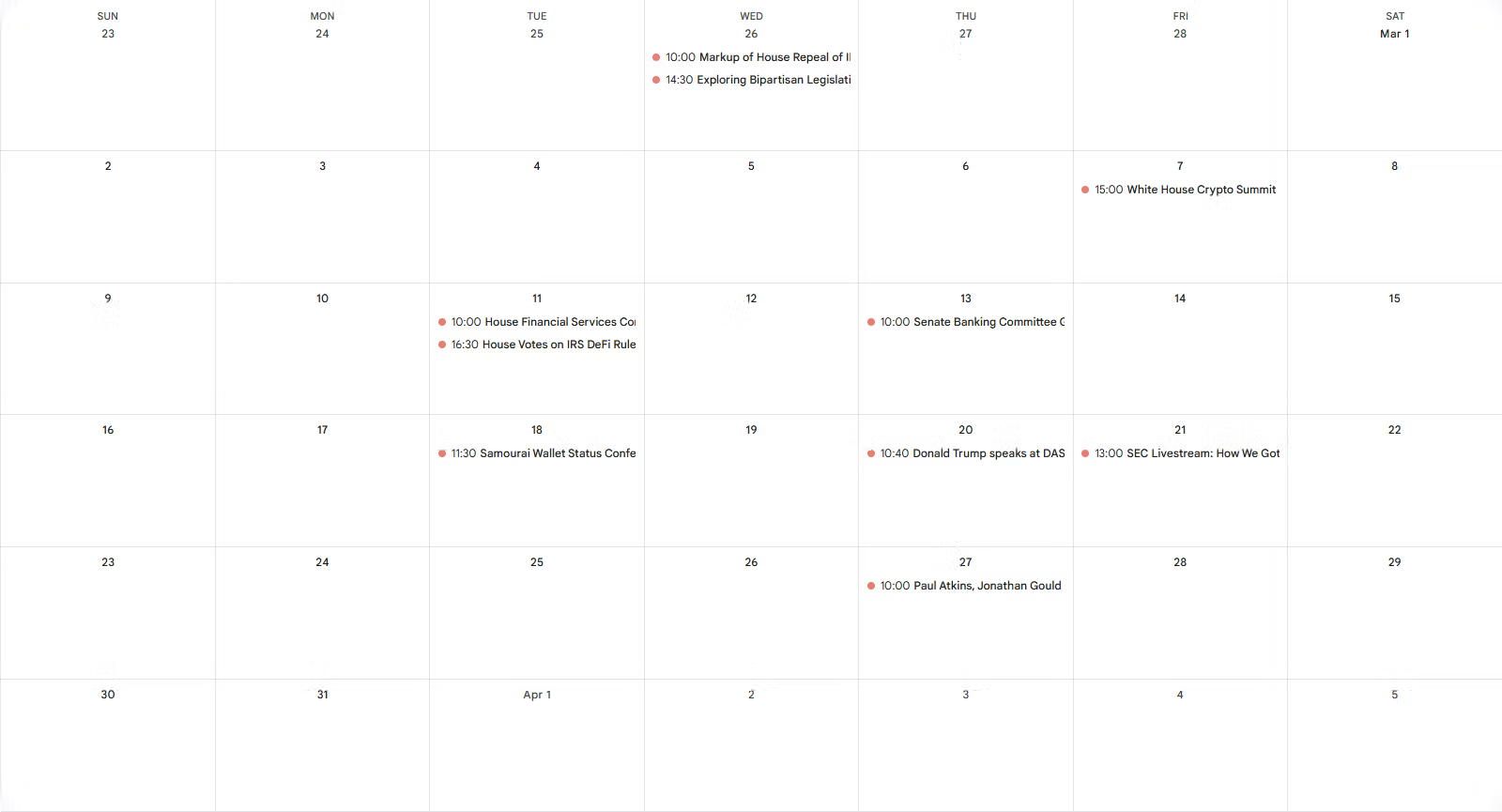

Securities and Exchange Commission is looking to reset its relationship with the crypto industry, even before a permanent chair is confirmed by Congress. The latest effort was Friday's roundtable, hosted at the SEC's headquarters in Washington, D. and featuring a dozen attorneys representing different views and positions within the crypto industry. You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions. Ostrich farms and orange groves The narrative The SEC's reset began when Acting Chair Mark Uyeda launched a crypto task force and oversaw his agency withdraw Staff Accounting Bulletin 121, drop a number of ongoing lawsuits, pause a few more and publish multiple staff statements about how the agency might look at memecoins and proof-of-work mining. Why it matters The SEC is arguably the most important federal regulator in crypto at the moment. While its sister agency, the Commodity Futures Trading Commission, may be the regulator that might one day oversee crypto spot markets, right now it's the SEC that most companies in the sector look to for guidance on what, exactly, it is they can do. Breaking it down The roundtable was split into two portions (three, if you count introductory remarks from the three commissioners): A roughly 90-minute moderated panel discussion, led by former SEC Commissioner and Paredes Strategies founder Troy Paredes, and a 90-minute town hall still moderated by Paredes but featuring questions from the general public. You can read CoinDesk's coverage of the panel discussion at this link .

SEC 'Earnest' About Finding Workable Crypto Policy, Commissioners Say at Roundtable

— The staff at the U. Securities and Exchange Commission has embraced the chance to finally work with the crypto industry to hash out policy for overseeing digital assets transactions, said Commissioner Hester Peirce, the head of the agency's crypto task force. The securities regulator is ready "to seek earnestly to find a workable framework," Peirce said at the agency's first crypto-focused roundtable on Friday. "I think we're ready for the spring ahead," she said, referring to the title of the day's event, the "Spring Sprint Toward Crypto Clarity. " The task, according to Peirce: "Can we translate the characteristics of a security into a simple taxonomy that will cover the many different types of crypto assets that exist today and may exist in the future? " Mark Uyeda, the agency's acting chairman, told reporters that despite recent SEC policy statements that certain areas of the crypto sector aren't subject to securities laws — memecoins and mining , so far — it's a "definitely possibility" that others will be defined as securities. "We're moving on multiple tracks here," he said in answer to a question from CoinDesk. Each statement issued so far "ultimately is a staff statement" that doesn't have legal backing, but he said the roundtable represents the entire commission — currently three members — looking at what a "potential commission interpretation might look like. " In his opening remarks at the event, Uyeda, who was appointed by President Donald Trump as the SEC awaits a Senate confirmation of Paul Atkins , argued that the agency should have been more willing in recent years to make such interpretations public. "When judicial opinions have created uncertainty from our participants in the past, the commission and its staff have stepped in to provide guidance," Uyeda said.

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Animal spirits in the crypto industry continue to be evident amid the eased regulatory stance of the Trump administration, with leading U. spot exchange Coinbase (COIN) in advanced acquisition talks with leading global derivatives exchange Deribit, reports Bloomberg . According to the story, the companies have notified Dubai regulators (where Deribit is licensed) about the discussions. Bloomberg earlier this year — alongside rumors that Kraken was discussing an acquisition of Deribit — reported Deribit could be valued in the area of $4 billion to $5 billion. Mostly known for its spot trading business, Coinbase (COIN) would be making a big push into the highly profitable crypto derivatives market with a purchase of Deribit, which saw trading volume in 2024 of nearly $1. 2 trillion — almost double that of the year prior. Earlier this week, another U. crypto exchange — Kraken — boosted its derivatives business with a $1. 5 billion deal to purchase Ninja Trader.